Indiana paycheck taxes

18 hours agoIndianas tax rate is 323 meaning those who are eligible to receive 10000 in federal loan forgiveness will pay up to 323 in taxes while Pell Grant recipients could owe. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding.

What Is A W 2 Form W2 Forms Printable Job Applications Job Application Template

Simply enter their federal and state W-4 information as.

. 14 hours agoDriving the news. Indiana businesses have to pay taxes at the state and federal levels. Payroll Tax Salary Paycheck Calculator Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Indianas 92 counties levy their own income taxes in addition to the state with rates ranging from 050 up to 290. The Hoosier State dropped its flat income tax a smidge in 2017 from 33 to 323 but many counties in Indiana also impose their own income taxes with an average levy. The Indiana paycheck calculator will calculate the amount of taxes taken out of your paycheck.

Indianas tax rate is currently 323 meaning those eligible to have their debt canceled will pay up to 323 or 646 in taxes depending on the amount of. Indiana State Centralized Collection Unit. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state.

Those eligible to receive 10000 in federal loan forgiveness in Indiana will end. To see how Indiana state income tax impacts your paycheck use the Indiana salary paycheck. Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic.

3 hours agoA representative for Indianas Department of Revenue confirmed the plans to Insider on Wednesday. Yes residents of Indiana are subject to personal income tax. Counties charge the same tax rate for residents and non.

Late filed returns are subject to a penalty of up to 20 and a minimum penalty of 5. 14 hours agoWith Indianas state income tax rate at 323 Hoosiers who receive 10000 in student loan forgiveness would have to pay an additional 323 in state income tax. Welcome to the Indiana Department of Revenue Pay your income tax bill quickly and easily using INTIME DORs e-services portal.

18 hours agoIndianas tax rate is 323 meaning those who are eligible to receive 10000 in federal loan forgiveness will pay up to 323 in taxes while Pell Grant recipients could owe. 185 rows Indianans pay a flat income tax rate of 323 plus local income tax. Indiana Income Tax Brackets and Other Information.

Remit Withholding for Child Support to. A state standard deduction exists in the form of a personal exemption and varies. Late filed WH-3s are subject to a penalty of 10 per withholding document W-2 1099 K-1.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana. Yes Indiana does have personal income tax. Learn How Individual Income Taxes Business Tax Corporate.

For the feds. Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with. The state income tax rate in Indiana is a flat rate of 323.

As an employer in Indiana you will have to pay the state unemployment insurance SUI which ranges from 05 to 74 on a wage base of 9500 per employee. Indiana child support payment information. The Indiana income tax is a flat rate for all residents.

2022 Federal State Payroll Tax Rates For Employers

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Cash For Your Car In Alabama Free Same Day Pickup Birth Certificate Template Alabama Car Title

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Tax What It Is How To Calculate It Bench Accounting

We Can Agree That The Income Tax Is The Worst Theft Of All Is The Fairtax A Good First Step Away From The Income Tax Libertar Paying Taxes Agree Income Tax

Indiana Paycheck Calculator Adp

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Indiana Paycheck Calculator Smartasset

2022 Federal State Payroll Tax Rates For Employers

Different Types Of Payroll Deductions Gusto

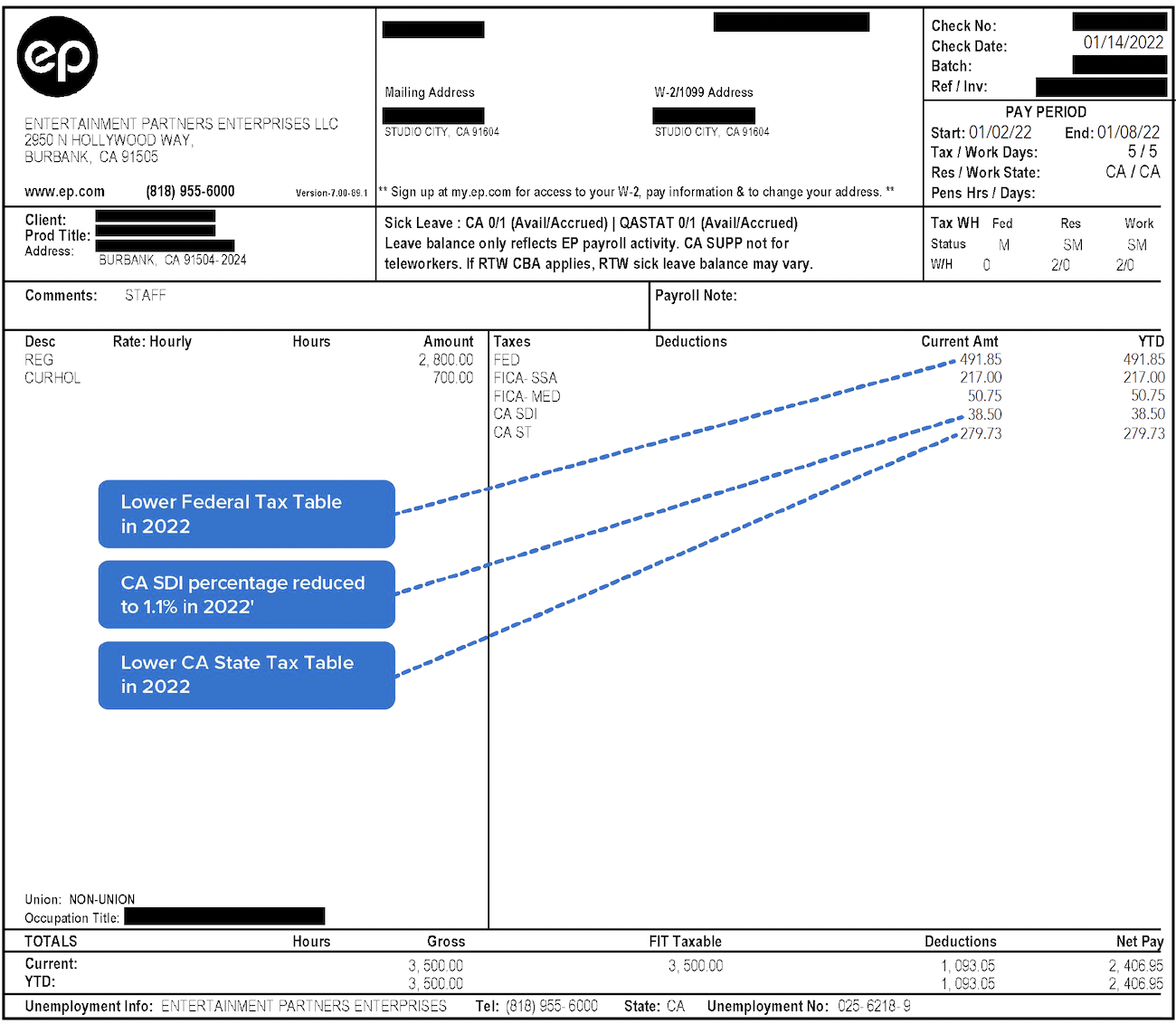

Decoding Your Paystub In 2022 Entertainment Partners

What Is Local Income Tax Types States With Local Income Tax More

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Payroll Tax What It Is How To Calculate It Bench Accounting

What Are Payroll Deductions Article